WesBank 03 October 2022: New vehicle sales for September showed reassuring stability in volumes for a number of positive reasons; but faced a host of negative economic influences during the month that is hampering overall market recovery.

Demand for new vehicles continues to remain robust as measured by WesBank’s applications volume. Applications for finance across both new and used vehicles was positive year-on-year, with demand for new vehicle deals out-performing potential pre-owned sales. “Consumers are clearly looking for value in the new vehicle market,” said Lebogang Gaoaketse, Head of Marketing and Communications at WesBank. “Despite the demand being in favour of new vehicle deals, the average deal size has remained consistent year-on-year, indicating that affordability remains a major consideration. Consumers are also making the choice in the face of pre-owned deals that display price inflation of over 20%.”

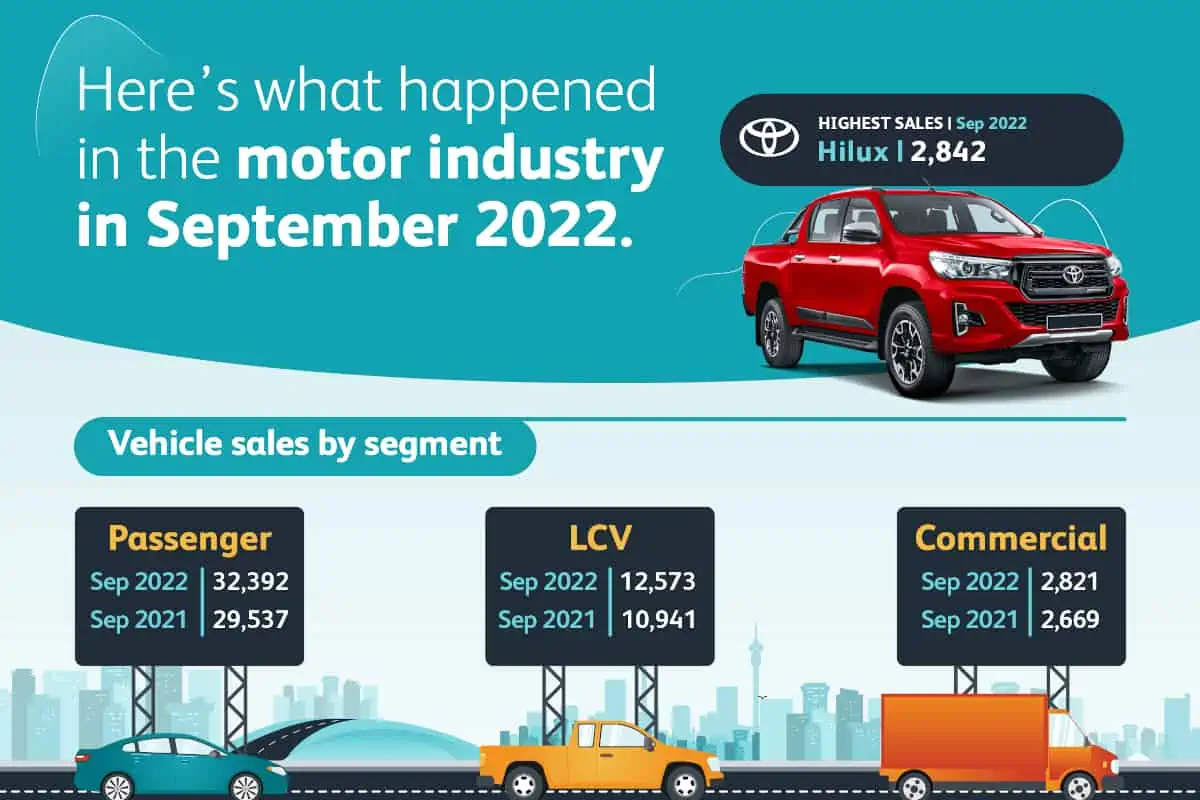

SA Vehicle Sales Figures for September 2022

Load-shedding impact on consumer and business confidence

That may have contributed to the stable performance of September new vehicle sales because there were two major detractors that the market faced during the month. “Load-shedding will continue to impact consumer and business confidence negatively. But it is the second major increase in interest rates of 0.75% that should be expected to bring a more immediate bearing to purchase decisions made on financed deals,” said Gaoaketse. “It should also be considered that Toyota vehicle volumes are recovering to more normal levels as production and logistics return to their operations.”

October new vehicle sales ended the month on 47,786 units, 10.8% up year-on-year and just 440 units ahead of August sales, according to naamsa | the Automotive Business Council. The month’s performance was enough to make it the second-best sales month of the year after March.

Light Commercial Vehicles (LCVs) out-ran the market to grow 14.9% to 12,573. Dealers enjoyed the segment growth, registering 13.2% growth in sales off the showroom floor to 11,368. There was also marked improvement (76.3%) from the rental market for LCVs, albeit in small volume of 654 units.

Rental demand did make a significant contribution to passenger car volumes, however. Up 22.3%, this added 6,117 units to the overall passenger car volume of 25,083, with the segment up 8.5% year-on-year during September.

“September sales and the performance of the first three quarters will provide an interesting framework for industry experts to discuss the future of the industry later this month at the inaugural South African Auto Week,” said Gaoaketse.

naamsa Partnership

WesBank has partnered with naamsa and the broader industry at the conference, which takes place at the Kyalami Grand Prix Circuit and Conference Centre from 24 to 28 October. “The participation of International Organisation of Vehicle Manufacturers (OICA) members from 39 countries during the week will ensure that this pinnacle event also has a strong international flavour and shows the importance of the South African motor industry on the continent.”

Year-to-date sales were 0.4% softer than the year to August, with the nine months up 13.4% to 391,936 units compared to the same period last year.

Here’s what happened in the motor industry in September 2022

Content and images supplied via MotorPress